-

or

Social Security Number

Tax ID Number

(& Spouse if applicable)

(& Spouse if applicable)

- Front and Back (& Spouse if applicable)

Drivers License

-

or

Social Security Number

Tax ID Number

(& Spouse if applicable)

(& Spouse if applicable)

- Dates of birth

- Childcare records (provider's , address, total year amount paid)

Tax ID Number

- Income of other adults in your home (dependents income may affect your claiming of them)

- Separated Parents (Form 8332) showing that the child’s custodial parent is releasing their right to claim a child to you, the noncustodial parent (if applicable)

- Separated Parents (Form 8332) showing that the child’s custodial parent is releasing their right to claim a child to you, the noncustodial parent (if applicable)

Employed

- Forms

- Forms - (Applies to employees of New York City uniformed services who reside outside of NYC)

-

W-2

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png)

-

1127 W-2

Unemployed

- 1099-G:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png) - Unemployment, state tax refund

- Unemployment, state tax refund

Self-Employed

- 1099:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png) Forms, Schedule K-1

Forms, Schedule K-1:max_bytes(150000):strip_icc()/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png) , income records to verify amounts not reported on 1099s

, income records to verify amounts not reported on 1099s

- Records of all expenses — check registers or credit card statements, and receipts

- Business-use asset information (cost, date placed in service, etc.) for depreciation

- Office in home information, if applicable

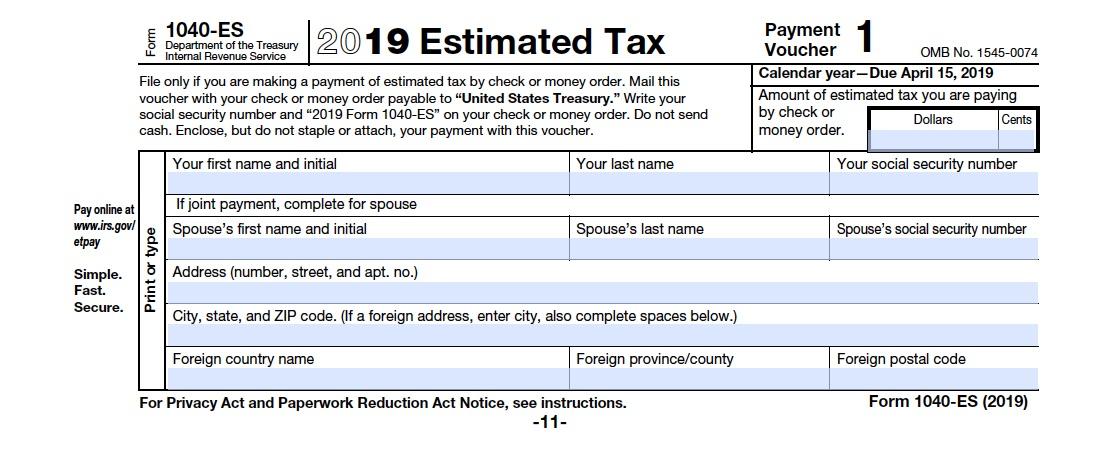

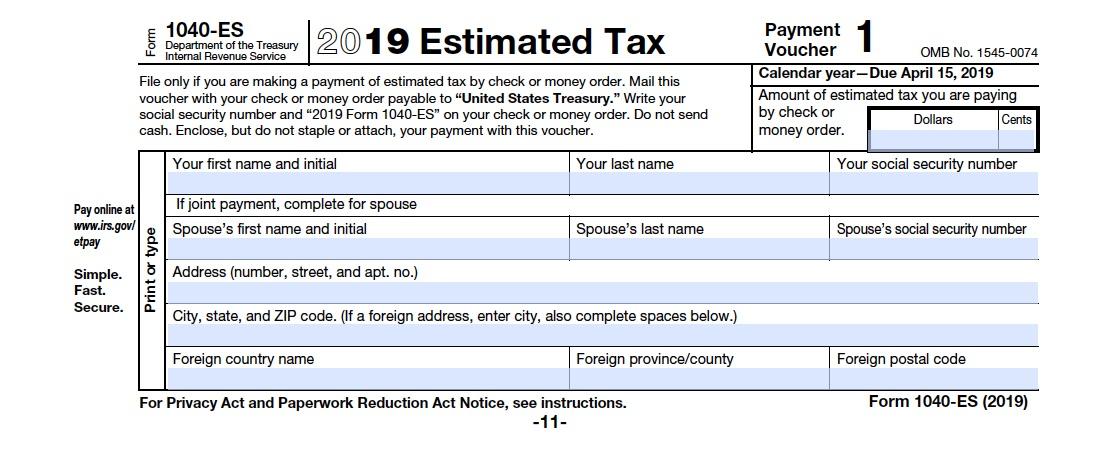

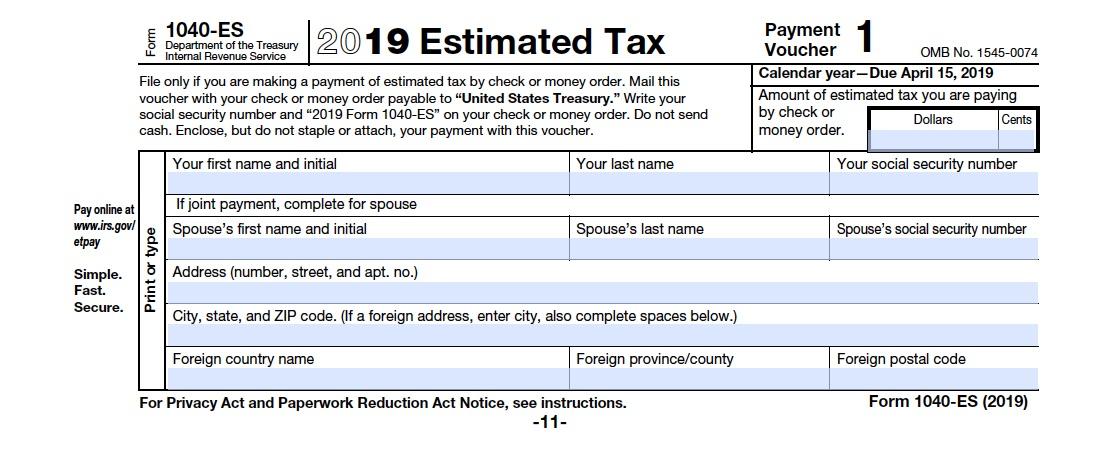

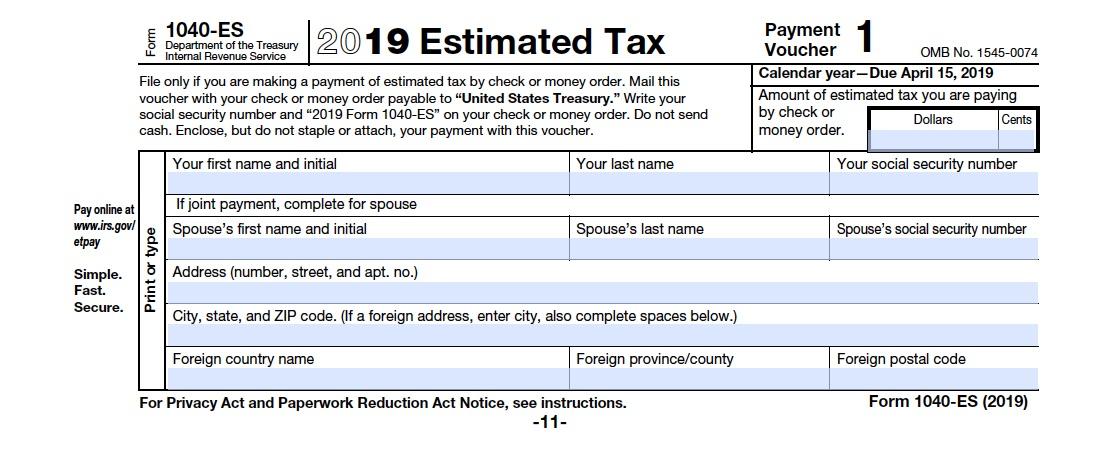

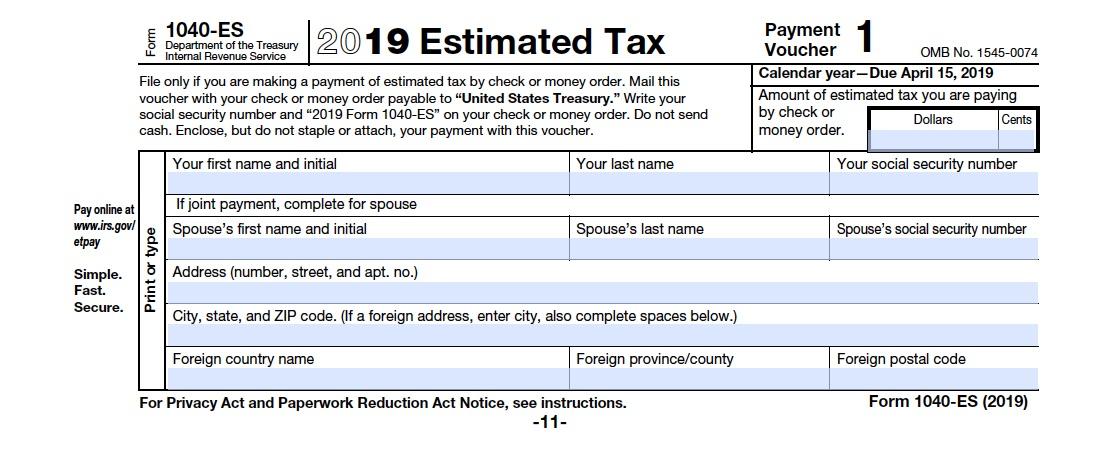

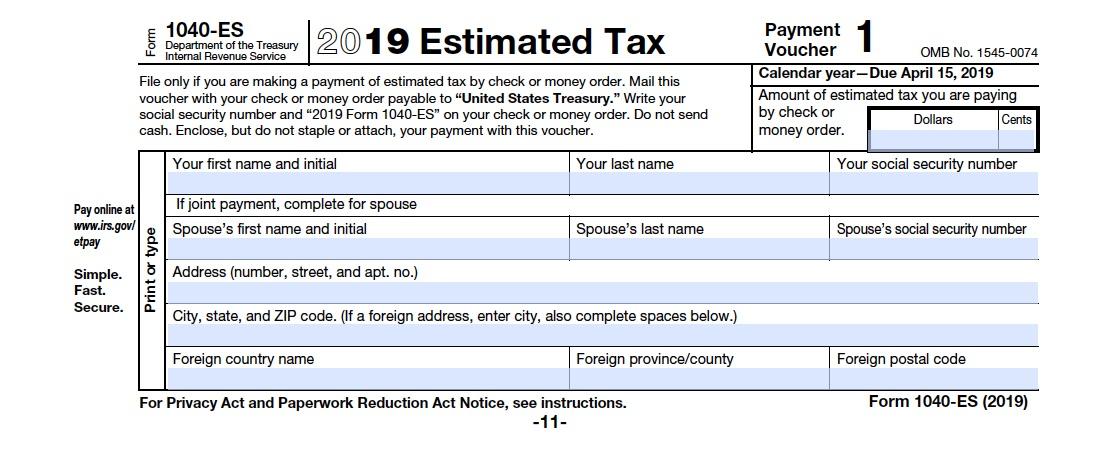

- Form 1040–ES - Record of estimated tax payments made

- Record of estimated tax payments made

Rental Income

- Records of rental income and expenses

- Rental asset information (cost, date placed in service, etc.) for depreciation

- Form 1040–ES - Record of estimated tax payments made

- Record of estimated tax payments made

Retirement Income

- 1099-R:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png) - Pension/IRA/annuity income

- Pension/IRA/annuity income

- 1099-SSA - Social security

- Social security

- RRB-1099 - RRB income

- RRB income

Savings & Investments or Dividends

- 1099-INT:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png) - Interest income

- Interest income

- 1099-OID:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) - Original Issue Discount

- Original Issue Discount

- 1099-DIV:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png) - Dividend Income

- Dividend Income

- 1099-B:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.53.11AM-3e34b458ed634edf8d428777afabc1d3.png) - Proceeds from broker and barter exchange transactions

- Proceeds from broker and barter exchange transactions

- 1099-S - Proceeds from real estate transactions

- Proceeds from real estate transactions

- 1099-SA:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) - distributions from Health Savings Account

- distributions from Health Savings Account

- 1099-LTC:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png) - Long term care and Accelerated death benefits

- Long term care and Accelerated death benefits

- Form 1040–ES - Record of estimated tax payments made (if applicable)

- Record of estimated tax payments made (if applicable)

- Consolidated reports from financial service provider

- Dates of acquisition and records of your cost or other basis in property you sold (if basis is not reported on 1099-B)

- Cryptocurrency Transactions (Virtual currency) (if applicable)

Other Income & Losses

- W-2G:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png) - Gambling income

- Gambling income

- 1099 Misc:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png) - Prizes and awards, Royalty Income

- Prizes and awards, Royalty Income

- K-1 Statement - Trusts

- Trusts

- Jury duty records

- Hobby income and expenses

- Record of alimony paid/received with ex-spouse’s name and SSN.

- Applicable to judgements prior to 12/31/18

- 1099-G

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png) - Unemployment, state tax refund

- Unemployment, state tax refund

Self-Employed

- 1099

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png) Forms, Schedule K-1

Forms, Schedule K-1:max_bytes(150000):strip_icc()/ScheduleK-1-PartnersShareofIncomeetc.-1-134752a3fa884035822acd99c23703e0.png) , income records to verify amounts not reported on 1099s

, income records to verify amounts not reported on 1099s

- Records of all expenses — check registers or credit card statements, and receipts

- Business-use asset information (cost, date placed in service, etc.) for depreciation

- Office in home information, if applicable

- Form 1040–ES

- Record of estimated tax payments made

- Record of estimated tax payments made

Rental Income

- Records of rental income and expenses

- Rental asset information (cost, date placed in service, etc.) for depreciation

- Form 1040–ES

- Record of estimated tax payments made

- Record of estimated tax payments made

Retirement Income

- 1099-R

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png) - Pension/IRA/annuity income

- Pension/IRA/annuity income

- 1099-SSA

- Social security

- Social security

- RRB-1099

- RRB income

- RRB income

Savings & Investments or Dividends

- 1099-INT

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png) - Interest income

- Interest income

- 1099-OID

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png) - Original Issue Discount

- Original Issue Discount

- 1099-DIV

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png) - Dividend Income

- Dividend Income

- 1099-B

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at10.53.11AM-3e34b458ed634edf8d428777afabc1d3.png) - Proceeds from broker and barter exchange transactions

- Proceeds from broker and barter exchange transactions

- 1099-S

- Proceeds from real estate transactions

- Proceeds from real estate transactions

- 1099-SA

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png) - distributions from Health Savings Account

- distributions from Health Savings Account

- 1099-LTC

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png) - Long term care and Accelerated death benefits

- Long term care and Accelerated death benefits

- Form 1040–ES

- Record of estimated tax payments made (if applicable)

- Record of estimated tax payments made (if applicable)

- Consolidated reports from financial service provider

- Dates of acquisition and records of your cost or other basis in property you sold (if basis is not reported on 1099-B)

- Cryptocurrency Transactions (Virtual currency) (if applicable)

Other Income & Losses

- W-2G

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.03.26AM-e376b945aa4e4b7381f63b10e4de9cc2.png) - Gambling income

- Gambling income

- 1099 Misc

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png) - Prizes and awards, Royalty Income

- Prizes and awards, Royalty Income

- K-1 Statement

- Trusts

- Trusts

- Jury duty records

- Hobby income and expenses

- Record of alimony paid/received with ex-spouse’s name and SSN.

- Applicable to judgements prior to 12/31/18

Home Ownership

- 1098 Form:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) - mortgage interest statements

- mortgage interest statements

- Real estate and personal property tax records

- Receipts for energy-saving home improvements (e.g., solar panels, solar water heater)

Charitable Donations

- Cash amounts donated to houses of worship, schools, other charitable organizations

- Records of non-cash charitable donations

- Amounts of miles driven for charitable or medical purposes

Medical Expenses

- Amounts paid for healthcare insurance and to doctors, dentists, hospitals

Health Insurance

- 1095-A Form - Health Insurance Marketplace Statement

- Health Insurance Marketplace Statement

Childcare Expenses

- Fees paid to a licensed day care center or family day care for care of an infant or preschooler

- Wages paid to a baby-sitter

- Don't include expenses paid through a flexible spending account at work

Educational Expenses

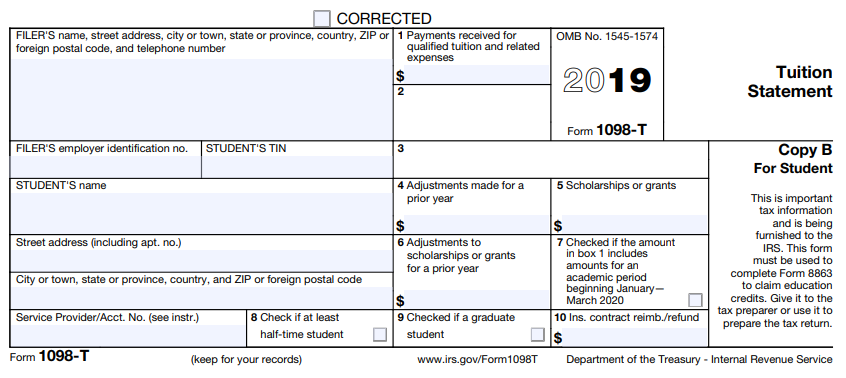

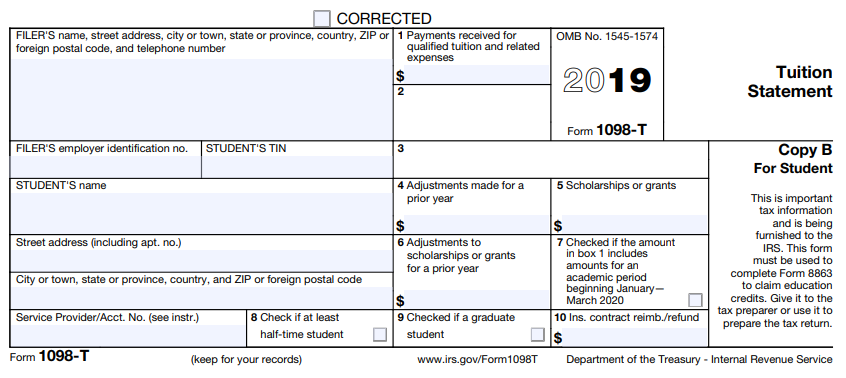

- 1098-T Form - from educational institutions

- from educational institutions

- 1098-E Form - student loan interest

- student loan interest

- Receipts that itemize qualified educational expenses

- Records of any scholarships or fellowships you received

K-12 Educator Expenses

- Receipts for classroom expenses (for educators in grades K-12)

State & Local Taxes

- Amount of state/local income tax paid (other than wage withholding), or amount of state and local sales tax paid

- Invoice showing amount of vehicle sales tax paid

Retirement & Other Savings

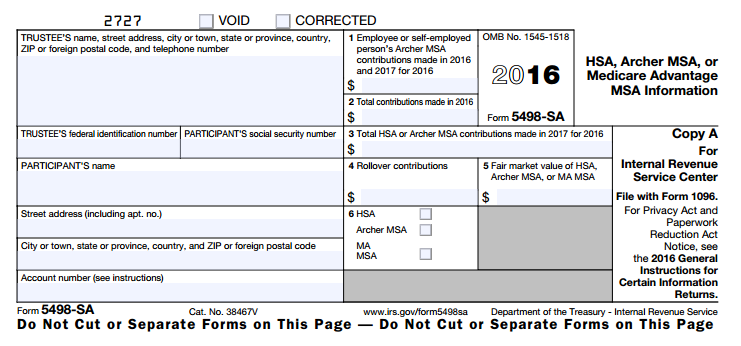

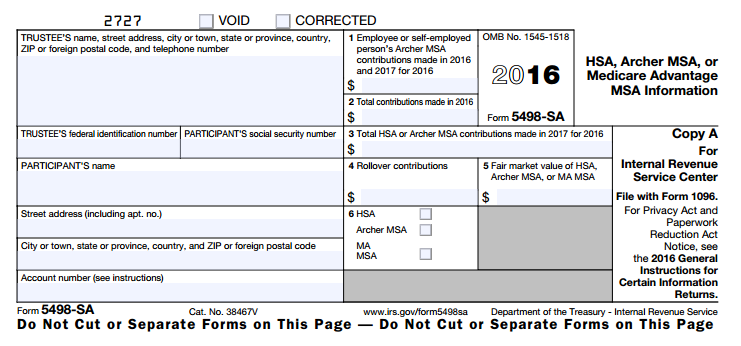

- 5498-SA Form - HSA contributions

Form - HSA contributions

- 5498 Form:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png) - IRA contributions

- IRA contributions

- All other 5498 series forms (5498-QA, 5498-ESA)

New York State

- Contributions to 529 Plans - Require a year end statement of total contributions.

- 1098 Form

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) - mortgage interest statements

- mortgage interest statements

- Real estate and personal property tax records

- Receipts for energy-saving home improvements (e.g., solar panels, solar water heater)

Charitable Donations

- Cash amounts donated to houses of worship, schools, other charitable organizations

- Records of non-cash charitable donations

- Amounts of miles driven for charitable or medical purposes

Medical Expenses

- Amounts paid for healthcare insurance and to doctors, dentists, hospitals

Health Insurance

- 1095-A Form

- Health Insurance Marketplace Statement

- Health Insurance Marketplace StatementChildcare Expenses

- Fees paid to a licensed day care center or family day care for care of an infant or preschooler

- Wages paid to a baby-sitter

- Don't include expenses paid through a flexible spending account at work

Educational Expenses

- 1098-T Form

- from educational institutions

- from educational institutions

- 1098-E Form

- student loan interest

- student loan interest

- Receipts that itemize qualified educational expenses

- Records of any scholarships or fellowships you received

K-12 Educator Expenses

- Receipts for classroom expenses (for educators in grades K-12)

State & Local Taxes

- Amount of state/local income tax paid (other than wage withholding), or amount of state and local sales tax paid

- Invoice showing amount of vehicle sales tax paid

Retirement & Other Savings

- 5498-SA

Form - HSA contributions

Form - HSA contributions

- 5498 Form

:max_bytes(150000):strip_icc()/ScreenShot2020-01-28at4.05.10PM-aaa74c7b441b4609ad379a16d4d624bf.png) - IRA contributions

- IRA contributions

- All other 5498 series forms (5498-QA, 5498-ESA)

New York State

- Contributions to 529 Plans - Require a year end statement of total contributions.